Insurance Coverage

Ensuring Financial Health and Security Through Adequate Insurance Coverage

Financial security is a crucial aspect of a stable and stress-free life. One of the pillars of financial health is having appropriate insurance coverage to protect against unexpected events that could otherwise lead to significant financial burden. In this article, we will explore the importance of insurance coverage and how it contributes to maintaining overall financial well-being.

Types of Insurance Coverage

There are various types of insurance coverage available to cater to different aspects of life and assets. Some common types of insurance include:

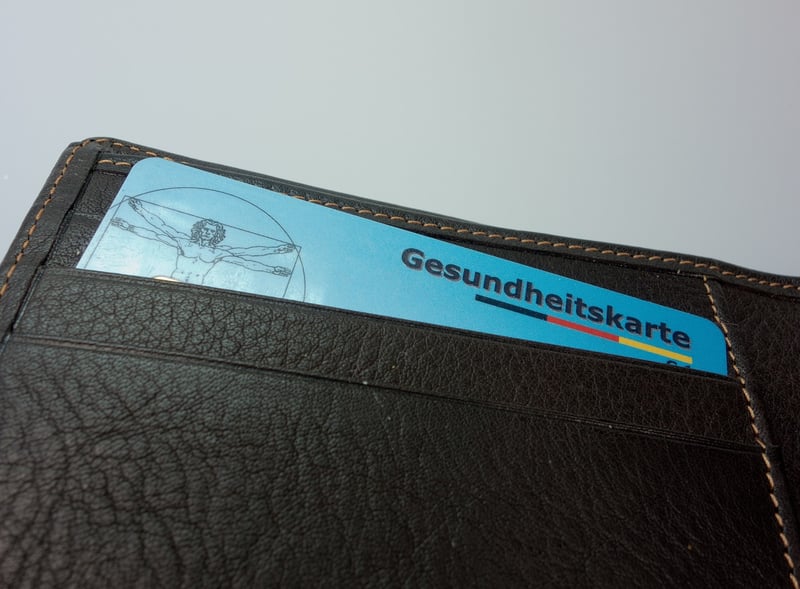

- Health Insurance

- Life Insurance

- Auto Insurance

- Homeowners or Renters Insurance

- Disability Insurance

- Liability Insurance

Each type of insurance serves a specific purpose and provides protection in different scenarios. For example, health insurance covers medical expenses, while auto insurance safeguards against vehicle-related damages and liabilities.

Benefits of Adequate Insurance Coverage

Having adequate insurance coverage offers several benefits, including:

- Financial Protection: Insurance provides a safety net against unexpected costs, such as medical emergencies, accidents, or property damage.

- Peace of Mind: Knowing that you are covered in case of unforeseen events can reduce stress and anxiety.

- Asset Protection: Insurance helps safeguard your assets, such as your home, car, or business, from potential risks.

- Compliance: In many cases, having certain types of insurance, like auto insurance or workers' compensation, is mandatory by law.

Choosing the Right Insurance Coverage

When selecting insurance coverage, it is essential to assess your needs carefully and choose policies that align with your lifestyle, assets, and potential risks. Consider factors such as coverage limits, deductibles, premiums, and exclusions to ensure comprehensive protection.

Additionally, regularly review your insurance policies to make any necessary updates based on changes in your life circumstances, such as marriage, the birth of a child, or purchasing a new vehicle or home.

Conclusion

Insurance coverage plays a vital role in maintaining overall financial health and security. By securing the right insurance policies, you can protect yourself and your assets from unforeseen events and mitigate potential financial risks. Remember to review your insurance needs periodically to ensure that you have adequate coverage for any new developments in your life.

Having the right insurance coverage is a proactive step towards securing your financial well-being and achieving peace of mind in the face of life's uncertainties.

Stay protected, stay secure!